00:06

I was in Hawaii when it happened. I was like, on a beach,

00:09

And then, like, Luna crashed. And I was, like, went to literally zero.

00:14

And I was, like, oh, man. And, like, for a day or two, I just, like,

00:19

like, it, like, kinda fucked up my vacation in a way, but not because I was, like, doing something. Like, I didn't even have access to my, like, my wallet's not just, like, on in the cloud. So, like, just wasn't home. I couldn't even sell if I wanted to. I couldn't do anything really.

00:32

And then I didn't even wanna be doing something. I was, like, I want to be enjoying this vacation. You know, what happened?

00:37

Can you tell me, like, you had told me you're like, Luna's kinda cool. And you're you told me, like, six or eight weeks ago. Yeah. Actually, so I did something cool too in the last few days. You'll see it come out. I

00:48

I I went really over the top with a piece of content. I haven't done this since I did that clubhouse thread that was extremely over the top, but I was like, I kinda find this entertaining and this might hit at the clubhouse one, like, really hit hit, like, I don't know, like, twenty million people saw that thing.

01:03

I did that again with the Luna stuff where I recorded. I basically am creating, like, a, almost like a John Oliver style show, you know, his show last week tonight or whatever, where he just kinda, like, dismantled one topic for, like, fifteen minutes, and it's, like, but it's peppered with jokes.

01:18

I did that on the lunar thing. So that's gonna come out last day or two, but that was a very fun exercise to try to like, so tell me what actually tried to be funny. But the story is I guess for those don't know. Okay. So,

01:30

here's the short here's the short version of the story. Short version of the story is You have Bitcoin, gets big, has this, like, anonymous creator, and it's supposed to do, like, one thing really well, which is, like, basically this, like, digital gold. And then you have Ethereum gets really big, and it's got this guy vitalic. He becomes the next cult hero. First, it was Satoshi for Bitcoin. Then it becomes vitalic.

01:50

And vitalik solves a major problem with Bitcoin, which is that he makes it programmable.

01:54

And Ethereum takes off, and Ethereum's more programmable form of money. But both Bitcoin and Ethereum have, like, one major problem, which is that they're not very good as actual currencies. Right? They're called cryptocurrencies,

02:05

but you don't use them as a day to currency. You don't use them to go buy stuff. And this is for like a variety of reasons. Right? Like, Bitcoin, if you try to spend it, you'll get taxed as if you just sold a home every time you do a transaction. And then the merchant doesn't want it because they're like, oh, shit. But tomorrow, this is gonna go down twenty percent in price. Like, dude, I'm not trying to invest. I just need money to pay for tomorrow's inventory. Like, I don't wanna take this in my coffee shop. And so it's not really you those aren't really you. So, basically, there's this idea of creating stable coins. There's a coin that's always gonna be worth one dollar. And, like,

02:35

this is the spoiler. It's like, you know, you don't want it to not be worth one dollar, which is what happened with with the Terra project. But, like,

02:43

you know, it's supposed to be worth one dollar. So the way that most people did it, the big ones, USDC tether, those are the two big ones.

02:49

They're, like it's basically, like, a like a safety deposit box. You give them a real dollar. They'll give you a digital dollar. And if you ever want your real dollar back, they're like, I promise it's in the bank vault. Whenever you need it, come back and redeem it.

03:01

And,

03:02

and those kinda have some controversy because crypto people don't like it because it's like, well, how do I know you're not lying? Do I know you didn't just take all that money in the bank vault and go spend it or invest it in some risky way? And that's why people think Tethr did,

03:15

does.

03:16

And, and also they're like, dude, what if the government just cracks down? This one company,

03:20

like, they could just, like, they have to operate in some country. Like, it's centralized.

03:24

The whole it's, yeah, centralized. This decentralization thing isn't real in that point. So okay. So that's the so the pro argument for this project that came out, that's the project called Tara and one of the currencies called Luna. So the idea was we need a decentralized stable coin. We need decentralized money. Does that mean that one person invented Tara And then another person invented Luna using Taris technology. No. No. Taris like the name of the company, TerraForm Labs. It's like a group of people who came together saying, we're gonna create a stable coin. And then the stable coin, one of them Like, it's called u s t. So think about it like the u s dollar version of Tara, u s t. And so that was their stable coin. That's the thing that's all always supposed to be one dollar Luna is the to like, Luna is the thing that backs it. Okay. So remember I said, like, the in the other version, what backs the digital dollar? It's a real dollar in a bank account. The way that the US dollar used to work was what backs the US dollar? Gold and Fort Knox. Right? And that that was before we got off the gold standard. But the idea is, like, what gives this currency any value is this, like, back in currency.

04:21

And so they were backing it with Luna, and Luna was meant to be this, like, it's like two they they basically created two coins, a stable coin, And then Luna, which goes which can actually go up and down in price as a stabilizing mechanism for the stable hunt. So whatever, these are some details. They're not super important to the to what actually happened. So But he was one guy. Right? Because I saw, like, there's like an easy guy. But, like, there there's a team. Right? There's, like, it's a company. Okay. That's like a startup. Right? Mark Zuckerberg. That's this guy. Doquan. Got it. So doquan, who's doquan? He's a pretty interesting character. Right? Because He basically

04:52

it's like Stanford, computer science,

04:55

graduates. He starts working on some, like, mesh networking internet thing, like, that was his first startup. And then he's like, oh, no. Crypto is like the future. I'm gonna create the stablecoin project. So

05:04

they come out with this idea, and there's basically Some people are skeptical because they've seen

05:10

this decentralized stable coin, this un this un collateralized

05:13

decentralized, decentralized

05:15

algorithm make a bunch of buzzword, but that's how you describe it. Sablecoin fail before. There was a project like this called basis cash, maybe five years ago. And basis basically raised, like, I don't know, eighty million dollars or something like that from, like, tier like, know, Andreessen Horowitz, a bunch of other VCs, but they didn't even launch. They were, like, they were, like, oh,

05:34

like, that we don't know if this algorithmic thing will will hold. So they kind of returned eighty five percent of the money as like a failed project.

05:42

So that was, like, the last big version of this that had come out. And then Tara comes out. And so Tara, the the difference was they were like, look, this works as long as there's demand for the stable coin. And so they were like, where's the demand come from? And at at first, This is, I guess, I said it was a short version. It's actually the long version story. But at first, he came out with us with this idea that was like, look, we'll use it for e commerce.

06:03

Because in e commerce, every time there's a transaction, you know, there's like a three percent credit card fee, basically.

06:08

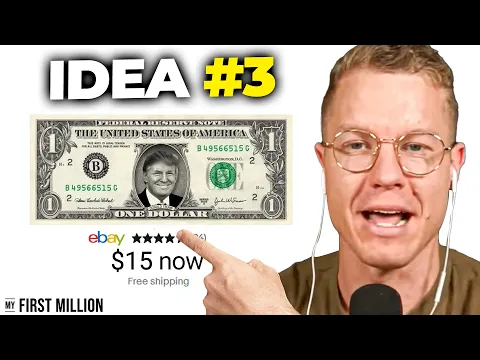

We can do it at one percent if we use crypto. And so it's like for a merchant, that's like, you know, that's real money that you get to save if somebody uses this this this option. And what they did was they're like, yo, we'll pass the savings to the customer and to the merchant fifty fifty. And then they, like, went and talked to all these e commerce companies in Korea where they're from, and they got, like, twenty seven large e commerce companies, including the second biggest one in in Korea to use them. So, like, imagine, like, the the set, like, not Amazon, but, like, let's say eBay. They got eBay to use it. So everyone's, like, pretty hyped. They're like, oh, shit. This is crypto with a real worth real world use case.

06:42

Finally, like, real world use case, this is your hyped on it. I was hyped on it. And this guy, because he was on stage, he's like, look, Krypto is full of a bunch of projects that have no real world use cases and very low user bases. We have, like, a real problem that we're solving, and we're gonna and we have real user. We have two million people using our payments app to do this in Korea. And I was like, wow. Awesome. I buy in.

07:06

I started with twenty five k, and then I had an opportunity to put in another two hundred k as part of, like,

07:12

a bunch of VCs were

07:14

buying,

07:15

Luna. Like, they invested in the company, and they were got they got to buy Luna at basically like a forty percent discount to the market rate. So at the time, it was trading at, like, almost a hundred dollars. We got to buy in at about just under forty dollars.

07:26

But it was, like, locked up. Like, it was gonna be released over the number of years. So You did that? I did that. I was like, oh, dude. I like this project anyways. If I get to buy it fifty percent under market, like, hell, yes. Sign me up. And also, like, these are all, like, tier one, like, crypto investors. Like, these I mean, it's they raised a billion dollars, right, from it from from investors. So it wasn't, like, some random project. It was like, oh, well, these guys are smart. They're doing it. Alright. Like, that's that validates my my belief. Okay. I'm gonna go ahead and and and do this.

07:54

And for a while, it looked like a genius move because

07:58

Luna was trading at, oh, I don't know, hit, like, a hundred sixteen dollars. It was, like, one of the best performers last year based on how much were you up by? In about a year and a half, Luna went from

08:07

under a dollar to a hundred and sixteen dollars. So it did like a hundred x in one year. I was in at, like, the kinda like the thirty, thirty five dollar price point overall.

08:15

Forty percent of thirty or thirty.

08:18

No. No. My my price point my actual price point was, like, thirty five dollars blended. So then you are you went two fifty, like, seven fifty. Yeah. Exactly. My two hundred my two fifty was, like, seven hundred fifty grand. I was, like, oh, great. Hang on. It's doing well. Like, this was just the start. It was, like, it was growing really fast. Like, not just the price, but, like, like, the number of people buying the stable coin was going up. Like, it went Like, I think the the stable coin had, like, at eighteen billion dollars of of TBL or something like that. So it had gotten pretty big.

08:46

But they had I I kinda noticed I was like, wait. They don't talk about the e commerce thing ever anymore. And that's because kinda, like, didn't work. Like, they basically

08:54

It was, like, working slowly, I think, like, merchants, like, kinda cared, but not enough. Consumers didn't really change their behavior. So it wasn't like a sexy growth story. I don't think it was working. They just stopped talking about it. And they started talking about, like,

09:07

so what they did was they're like, alright. Now instead, we'll serve the crypto community itself with a savings rate. So a savings account. So, basically, there was a savings account on the network that was, like, if you deposit your stable coin here, you get paid twenty percent interest

09:19

on your stable stable coin, which is, like,

09:22

kind of amazing. Right? Because, like, if I take my dollars, I go to Bank of America, I get Yeah. But that sounds like some policy scheme shit. Sounds like it. Right? But it's not. I'll tell you why. So it was, like, Bank America gives you point o two percent. This was giving you twenty percent. And and so a lot of critics said exactly what you said, which is, oh, this is a ponzi. And I will argue it is not a ponzi. It was even better than a ponzi.

09:45

So I like Like, what's more not from a ponzi? Okay. So a ponzi can league. Okay. Basically. So Ponzi is customer a gives you money. You use that money to pay out customer b. Then customer b gives you money because they have faith in use that money you pay out c and d. So you're taking one customer's money paying out the other. This was even better. They just created a currency out of thin air printed like a billion of it. Then they they and then they just gave it away. Right? Like and, like, the marketplace is in high value. So Have you seen it on, what's the where they have Patty's Patty's dollars?

10:15

Yeah. Patty's bucks. It's always sunny. Patty's bucks. It's always sunny. Yeah. That's exactly what happened. They just created their own currency and just collected the dollar. In a way, that's what all currency start. Right? The US dollar, every country does this. They create their own and you if you believe is valuable, then it becomes valuable. If you if you cease believing it's valuable, then it devalues, and we see this in different countries. And that's what happened here. For a while, people believed it was valuable, and they kept investing in it.

10:36

And two things happened. One was everybody knew that this twenty percent savings rate is not sustainable because

10:42

What they were okay. The the the reality the joke that that was my joke version of description. The reality was when they raised a billion dollars from investors, They basically were like, look, this savings rate is really good customer acquisition. It's a marketing budget. Just like Uber subsidizes

10:55

your rides, like, Why was an Uber ride back when we all started using Uber, like, twelve dollars when a taxi would have been twenty eight? It's like because VCs were basically giving you money, and they were losing money on the rides. That's what Tara was doing. They were losing money on this savings rate, but they were getting a whole bunch of new customers. So, like, they got, like, four million people almost to create wallets on the network. So it was, like, they were buying user acquisition. Now you could argue that was either dumb or not dumb, but it was definitely unsustainable. And everybody kinda anybody smart new that that's unsustainable, but it's like, hey, look, I get rewarded for being early here. I'm gonna get this subsidized earnings savings rate, and that'll go away as this gets more popular. But, like, cool. That's my benefit for being early. That's how almost every crypto project works. And, it's all is how many many startups work as well. Investors subsidize.

11:42

The usage of your free product until it's big enough where they'll start to charge or raise prices.

11:47

To and then to get to the, kinda, like, fast forward to the crash. I care I care about your take like, what happened to you. But to get to the crash, what happened? To get to the crash. Okay. So all along the way, people are like, hey, algorithm is stable coins that they only work when demand keeps going up. Once demand starts to fall, this thing will free fall. So, yeah, you have demand right now. That's why everything looks good. But once this starts to fall, it'll create a death spiral. Meaning,

12:13

once people stop wanting USC, Luna's price will go down. People will start once bluenose price crisis starts to be now, people start selling Luna. And, basically, it's just like interplay

12:22

between if

12:24

If USD either started to de peg, meaning instead of being worth a dollar, it was worth ninety five cents, people will not want it. They'll lose confidence in the in the stable coin. And then as they lose confidence, they'll they'll sell, which will create more supply of Luna, which will cause the price of lunar to go down. And then that will cause even less confidence in the whole project. And it it'll just death fire. That was this is the belief. And all along this guy, Duquan, who started off, like, you know, seeming like this smart kinda wanna change the world kinda guy, He'd become, like, kind of an egomaniac and it was part of his persona. Like, he was, like, a Donald Trump or Elon Musk style guy, where if you were if you disagreed with him, he didn't just say, you know, like, grew. I mean, let's agree to disagree. Like, he was like, I will shit on you. I will call you stupid and poor and, like, I will make fun of you. Is that literally what he said? Yeah. He would call everybody stupid, poor, and he would basically

13:12

say you're all they're all funsters just spreading fun, which is fear uncertainty and doubt, you know, you know, And look, they've been wrong all all the way so far. They're gonna keep being wrong. And this is exactly what Elon did about people who were shorting his stock. He was like, oh, it's gonna be the short burn of the century You guys are gonna look so stupid. And, and and, you know, people are betting against them. People are betting for them. So anyways, yeah, buddy, this guy forgot, like, the thing to make this work is you have to be right. Exactly. And he was right for a while until and and by the way, it's really funny. There's one Twitter account that wasn't just saying, hey, this ain't gonna work. He's like specifically laid out a, like, fifteen step plan of, like, hey, look, I did the math. If somebody was motivated and had a billion dollars, they could destroy Tara, which is currently worth forty billion dollars. So they could If you put up if you had a billion dollars of cell pressure, I think you could crack the whole Tara project.

14:01

It would have to be like a smart focused person who would have to time it right. So and that's And, basically, he he he retweeted that. It was, like, this is, like, famous last word. So he goes, man, this is the most beep, our word.

14:14

Thing I've ever read on Twitter.

14:17

Well, billionaires in Friday. He said retarded? Yeah.

14:21

Really? Yeah. What a dumb idiot. Wow. Do you do that?

14:25

Did you call him a dumb idiot?

14:27

Well, like, but, like, why would you just kinda like dumb idiot would do such name calling. How how can you how do you speak like that when you're, like, this, like, like, a CEO of, like, a It's, like, Donald Trump called Mexicans rapists and stuff. Dude, this is, like, crazy. Like, people are crazy. They do crazy shit, and then they're basically their fans in his case were called lunatics. We're like, yeah. And then, like They thought that was cool. Well, I don't know if they thought that specific wording was cool, but in general, his character. I mean, he renamed himself stable quan. He became a billionaire. He, like, got a million Twitter followers because he became a cult of personality. Similar to you like that. One idiot, though. So anyways, he tweets it and he's really an idiot because he he said, this is the most r word thing I've read on on Twitter all week.

15:07

And he goes,

15:08

billionaires who follow me, go, like,

15:12

please go ahead and try this.

15:15

And, like, sure enough, like, two weeks later or a week later, it's, like, and try it. They did. So, basically, somebody or some group, it's not confirmed who it is, it's not confirmed also that there's a coordinated attack, but it does seem like it. People started,

15:30

somebody started dumping, like, a billion dollars worth of the stable coin. Which caused the peg to to go down. Right? When you have that much cell pressure, it won't stay worth a dollar. It'll slip to ninety two cents. And then it's and then on on top of that, they were also dumping Bitcoin, which was the reserve collateral that these guys are holding. So Bitcoin's price starts to go down. USD starts to break peg. People start to panic a little bit. And they also started withdrawing from so they did three things. They took it out of anchor, the the savings protocol. So you solve a billion dollars worth or whatever. Like, withdrawals,

16:01

then you saw them sell it, then you saw Bitcoin price tanking, and all of a sudden people started getting a little worried about, oh, shit. Is something bad happening? To Tara. Let me just go ahead and sell. So more people start to sell. And so you see, like, three, four, five billion dollars of sales happening at a very short period of time. And this also

16:19

coincidentally

16:19

or very planned happened right when they were doing, like, I've kinda, like, imagine you're like, oh, I'm just I'm moving houses right now. I was like, oh, man. The doors are open, because you're the moving trucks outside. So the doors are open, that's basically what happened. They were moving all day liquidity from the liquidity pool, from one to another. And so there wasn't much. There there was less shock absorbers than than you would expect when they started selling. It went from a hundred over a hundred dollars to what? What's it at now? Less than a penny. Like fractions of what? Okay. So how much value was wiped out? Forty something billion dollars, forty eight billion dollars. That is crazy. That is crazy. And stable coin went from selling So that's Luna. Tara, the stable coin, the USDA was selling a, you know, it's a dollar. It's supposed to always be a dollar. It goes ninety two cents, eighty five cents. So I'm on I'm on the beach in Hawaii, and I'm just getting texts from Ben. Yo. Tara's depegging.

17:07

And it's like and then it it goes down to seventy cents. Then it shoots back up to ninety giving false hope for a second, and then it plunges to sixty five, sixty, fifty. I think it's currently trading, I don't know, fifteen cents to the dollar, something like that. You're you're you're out two fifty.

17:19

I'm at two yeah. Two twenty five, something like that. How does that feel?

17:23

I mean, it feels shitty, of course. Right? Like, you know, lose one hundred dollars. When when you're sitting in Hawaii? She doesn't really care to know nor does she, like, want to know the details?

17:33

I told her, I was like, oh, well, from all of crypto, I was like, we lost several million million dollars in the last, like, three months because crypto has just been selling off like crazy.

17:41

And she's like, okay. So, like, should I shouldn't buy this bag or I should? I was like, I think it's a shouldn't right now. Let's go ahead and hold off on that. I was like, That's the level of conversation we've had,

17:50

about the whole thing. Like, she's not she's she stresses about micro stuff. Like, if we're if we have a, like, a late fee or a parking ticket, she'll freak out. But on the big thing, she's, like, very chill. She's, like But how do you feel about that now now that you've lost

18:02

you said something so let's just say three million dollars. Like,

18:06

I guess, a a couple of feelings. The first was I'm not surprised. Like, we went in pretty eyes wide open, which was This is a risk reward type. And you don't just say that. You have to, like, actually know what is the risk, and the risk was always nobody's ever made an algorithm stablecoin work. And by the way, he's a spo one spoiler.

18:23

This guy, Duquan, turns out he was also the anonymous cofounder of Basis. That that got leaked as well. So it's like, dude. You know, fool us all once, you know, shame shame on you, fool us twice. What the hell is wrong with you? That's my take on it. Did he did he tweet out? Like, I'm I'm sorry. I'm a dick or, like, He's he it's like, look, we didn't mean for this to happen, obviously. Like, I have no because some people are like, dude, did you

18:47

Did you benefit from this in some way? Like, because that happens with crypto. People will, like, raise a bunch of money, do a bunch of stuff and, like, run away with the money. His claim is no. We didn't, like, we lost more than anyone on this whole thing. I feel really bad that this happened. And he's kind of just, like, you know, tail between his legs a little bit and he's silking and he's quiet or he's much quieter now. While everybody's, like, dancing on his grave deservedly so because he was cocky as hell. Right? So, like, that's what's going on with him. With me, it's sort of, like, Alright. Lost those this money, that's not good, obviously. But, like, you know, doesn't feel good. It's sort of jarring. Like, I've had startup investments go it kinda happens over a longer period of time. This is, like, you wake up on Tuesday and, like, one of your best performing investments has gone to zero in twenty four hours. It is quite jarring to watch the price drop like a knife,

19:31

and be pretty helpless. Like, there's nothing you could really do about it. Partially because my luna tokens were locked up and partially because I was away from my computer,

19:38

you know, so, you know, whatever. But you're you're you're not I would, like I mean, I would lose sleep over that. I would be, like, I'd almost

19:46

almost

19:47

not not quite scarred but like a little bit. Like, it would almost be a it would be close to where I would describe it as traumatic.

19:55

Yeah. It's not that,

19:57

for me. And again, I think it's because

20:00

I I mean, I write down whenever I do an investment. Here's my Here's why I think there's a good investment, and here's what could go wrong. And the one could go wrong was exactly this, which is, like, people think that there could be if if there was a bank run, that this would death spiral. I see no reason that this wouldn't death spiral if there's a bank run. I don't know what would cause a bank run, but it's possible. And it's like, oh, what would cause a bank run was, like, either a motivated player created panic at a time when the project was vulnerable because all the the all markets, stock markets, crypto markets are all down, and they were moving the liquidity. Right? So it's like Well, the risk kinda played out. Like, that's okay. Like, it's like, you know, it's like I've had pocket aces get cracked before, and I I wouldn't even call Luna pocket aces. It's like, I had a flush draw. They got beat. Okay. You know, like, to use poker terms. Like, I had a flusher that got beat. Like, that's what happens. Even if I was, even if I had a sixty percent chance of winning, okay, I got my money in good. But, like, it wasn't my life savings. Now there's a lot of people who lost a lot more money on this because they put in a lot of money. So to me, there's also, like, a post mortem of, like, Okay. There's some rules. Like, you don't you don't put more than, you know, fifteen percent in any one project because all of them have these, like, Black Swan risks. And so you never wanna be that vulnerable to any one thing. Is is the majority of your net worth in crypto right now?

21:12

It was. Not not until

21:14

Everything cut down. Well, yeah. Not not including private, like, not including private business.

21:19

Of the liquid stuff? No. It's a little less than half now. It's a little more than half before. So, you know, but, like, the stock market also has great. I don't know. I haven't really got exactly. I've lost so much. I don't log into my thing anymore. I I've just I don't even look at it. Yeah. From I'm not gonna do it. I'm not gonna go trade right now. So for mental health purposes, I don't go calculate my net worth when it's when it's so far down.

21:40

You know, there is a good forcing function. I'm like, alright. Great. Let me make sure I'm earning money, working hard. Right? Like, it was very easy when when, like, over the last year, a year and a half, let's say, since the kind of COVID

21:52

you know, money printing says I mean, the whole ten years has been a bull run or whatever, but, like, the last year and a half, like, shit just inflated like crazy, So it was like, man, do I even need to work? Like,

22:02

I'll just look up every day, and I made a whole year's salary in a day. Like, you know, this is it's kinda demotivating.

22:08

To work. And then this is highly motivating to work when you start losing a year's salary per day, you know, like, that starts to, you know, like add up. And so, yeah, I don't know. Like, that's, I guess, my full reaction to it. Me too. That's exactly mine as well. It's, like, you just just make more money.

22:24

Yeah. Exactly.

00:00

22:42

Coming soon!